401k withdrawal tax rate calculator

Retirement Withdrawal Calculator Terms and Definitions. Assume the 401 k in the example above is a traditional account and your income tax rate for the year you withdraw funds is 20.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax rate.

. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Assume the 401 k in the example above is a traditional account and your income tax rate for the year you withdraw. The IRS generally requires automatic.

Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds. The early withdrawal penalty if any is based on whether or not you would be taking the withdrawal from your retirement plan prior to age 59 ½. Individuals will have to pay income.

Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. Contributions to a 401k are made pre-tax investments grow tax-deferred and income taxes are paid on withdrawal at the tax rate applicable at the time of withdrawal. When you make a withdrawal from a 401k account the amount of tax you pay depends on your tax bracket in the year when the withdrawal is made.

Amount You Expected to Withdraw This is the budgeted. Contributions to retirement accounts can be made pre-tax as in a. œ v 2lÂÀêù½MíîËéËMÜHm2 Þªð ao2åDˆšq9 7Ü9óûv 6 bávÂl xÒWÉ ƒ õÀ WËqÓÚœêÙØßmwìAÄÙÊÍºÍ CrÜ t0 L8äjʼw-bCÛ1Á Ù AlÔ-wÏnÅy4.

A 401 k can be one of your best tools for creating a secure retirement. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plan among others can create a sizable tax obligation. For traditional 401 ks there are three big consequences of an early withdrawal or cashing out before age 59½.

Early withdrawals from IRAs or 401ks are both subject to a 10 penalty along with standard income taxes. Early withdrawals from retirement accounts. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus.

Expected Retirement Age This is the age at which you plan to retire. Our free 401 k. For example if you fall in the 12 tax.

In this case your withdrawal is subject to the. Calculate your mortgage payment. Traditional IRAs and 401ks are two of.

First all contributions and earnings to your 401 k are tax deferred. 401k tax withdrawal calculator. Traditional 401 k withdrawals are taxed at an individuals current income tax rate.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. If you are under 59 12 you may also be. Jun 29 2022 401 k Distribution Calculator.

Taxes will be withheld. The tax treatment of 401 k distributions depends on the type of plan. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments.

It provides you with two important advantages. We have the SARS tax rates tables. If you withdraw money from your.

Using this 401k early withdrawal calculator is easy. 401ks and similar plans - 403bs 457s and Thrift Savings Plans - are ways to save for your retirement that your employer provides.

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

401k Calculator

How To Calculate Taxes Owed On Hardship Withdrawals 13 Steps

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Tax Withholding For Pensions And Social Security Sensible Money

Free 401k Calculator For Excel Calculate Your 401k Savings

Retirement Withdrawal Calculator For Excel

After Tax Contributions 2021 Blakely Walters

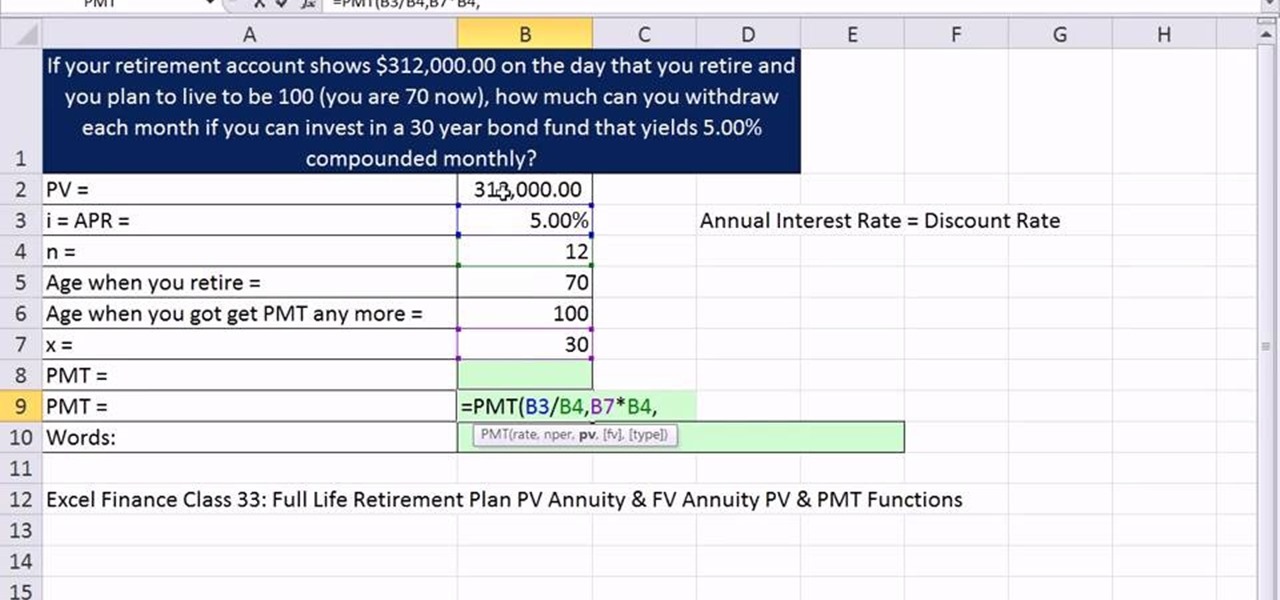

How To Calculate Monthly Retirement Income In Microsoft Excel Microsoft Office Wonderhowto

Free 6 Sample Retirement Withdrawal Calculator Templates In Excel

Retirement Withdrawal Calculator How Long Will Your Savings Last 2020

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Traditional Vs Roth Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

How To Calculate The Income Taxes On A 401 K Withdrawal Sapling

What Is The 401 K Tax Rate For Withdrawals Smartasset

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock